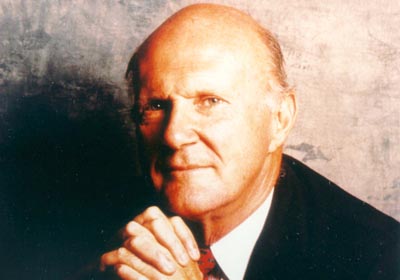

Prominent hedge fund manager and multi-billionaire

Julian Robertson, a Wall Street investor who with a handful of others pushed short-selling into the mainstream, helping to create the modern hedge fund industry, died on Tuesday at his home in Manhattan. He was 90. As a retired money man he lorded over the ultimate fund of funds. Since 2000 has invested in 30 hedge funds, many run by Tiger Management proteges. Born in North Carolina, first job at Kidder, Peabody. Appointed to run firm's money management operation 1974. Founded hedge fund Tiger; assets grew to $22 billion in 1998. Averaged 31.5% annual return before fees. Then the tech bubble burst; suffered severe losses, investors fled. Parceled out cash to former employees; today group includes billionaire managers Steve Mandel, Lee Ainslie. Also owns vineyards, golf courses in New Zealand. He continued to manage his own multibillion-dollar fortune well into his 80s. From Tiger’s inception in 1980 to its 1998 asset peak, Mr. Robertson produced annual returns averaging 31.7 percent after fees, dwarfing the 12.7 percent rise in the Standard & Poor’s 500 stock index over the same period. Tiger showed losses in only four of its 21 years. Born in Salisbury, N. C., the son of a textile executive, he graduated from the University of North Carolina at Chapel Hill. In addition to his son Alex and his sister Wyndham, Mr. Robertson is survived by two other sons, Spencer and Julian III, and nine grandchildren. Another sister, Blanche Robertson Bacon, died in 2021.